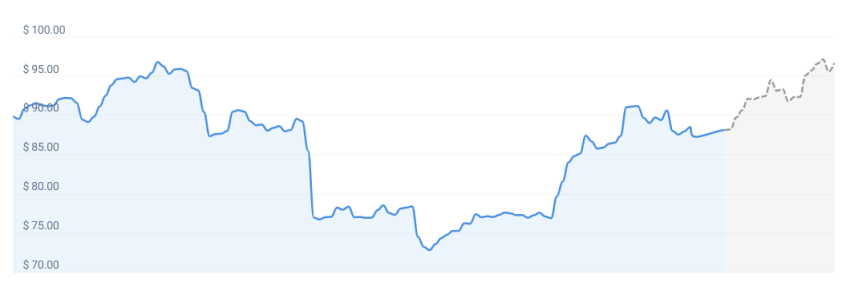

In the dynamic world of cryptocurrencies, Litecoin has persistently established its place as a popular alternative to Bitcoin. As per our current forecast, this “digital silver” is set to see a rise of about 9.04%, reaching an anticipated value of $96.71 by July 2, 2023. These predictions are based on the synthesis of market analysis, trading volumes, and recent price trends.

Understanding the sentiment behind a cryptocurrency can prove essential for deciphering its potential market movement. According to our technical indicators, the current sentiment around Litecoin remains neutral. This sentiment is established on the basis of a broad analysis of a myriad of factors including recent trading volumes, price fluctuations, and market trends.

Paradoxically, the Fear & Greed Index, an established gauge to assess the market’s emotional state, places Litecoin at a score of 59, indicating ‘Greed’. This index provides a holistic view of the market sentiment, combining factors such as volatility, market momentum, social media sentiment, and surveys into a score ranging from 0 to 100. A score over 50 suggests bullish market sentiment, indicating that despite the neutral technical indicators, investors continue to harbor faith in Litecoin’s potential.

Reflecting upon Litecoin’s recent performance, the cryptocurrency recorded 57% green days over the past month. This suggests that on 17 out of the past 30 days, Litecoin’s closing price was higher than its opening price, indicating a certain level of resilience amidst the prevailing market volatility.

Indeed, the past 30 days saw Litecoin’s price undergo a volatility of 8.01%. High volatility can often deter certain investors who are risk-averse, but it can also present potentially profitable opportunities for those willing to take on more risk. For example, seasoned traders might be able to leverage this volatility for short-term profits, while those who believe in Litecoin’s long-term potential may view these price fluctuations as opportunities to accumulate more coins.

Based on our current Litecoin forecast, we conclude that now might be a good time to invest in Litecoin. This suggestion, primarily informed by our forecasted price rise and the bullish Fear & Greed Index, should be taken as part of a broader investment strategy and not as individual financial advice. As with any investment, cryptocurrencies come with their own set of risks, and it’s essential for each investor to conduct thorough research and due diligence before making any investment decisions.

In conclusion, Litecoin presents a complex yet fascinating scenario in the cryptocurrency landscape. Despite the neutral sentiment from technical indicators, a projected price increase and a bullish Fear & Greed Index point towards a potentially profitable market environment. The upcoming period seems favorable for buying Litecoin, but as with all cryptocurrencies, the situation could swiftly change in response to new market developments.

As we continue to track the evolution of Litecoin and other digital currencies, we remain dedicated to providing our readers with insightful, data-driven analysis. The realm of cryptocurrency is a thrilling yet intricate landscape, and our mission is to help both novice and experienced investors navigate it with greater confidence and understanding.